How Much Should You Save for Tax?

🎧 Listen Now: Sidehustles.co.uk One-Minute Podcast - Navigating Tax Payments using the TAP system.

How Much to Save for Taxes: A Side Hustler's Guide

As a Chartered Accountant who has spoken with thousands of small business owners, a common question they have is "how much should I save for tax".

Tax requirements can be complicated, particularly when juggling them alongside a side business. If you've been grappling with questions like "How much should I save for taxes?" or "What percentage of my income should I set aside for my tax bill?", know that you're not alone. This guide aims to simplify the process with straightforward advice and an easy system you can use for saving for your tax obligations.

Read on to learn how much you should actually be setting aside, understand the simplicity of my Tax Allocation Percentage (TAP) system, and prepare yourself for your annual Self-Assessment Tax Return. While I can't promise you'll look forward to paying your taxes, at least they won't come as a shock!

PAYE vs Self-Employed Tax Systems

Many of us don't give much thought to tax and national insurance when we're employed. Under the PAYE (Pay As You Earn) system, tax calculations are straightforward and automatically handled by our employers.

However, when you're self-employed or running a side hustle, the responsibility for managing your tax affairs falls squarely on your shoulders, making it crucial to understand your tax obligations and the

self-assessment system.

Why 25%

Saving 25% of your profits is advisable if you're a basic rate taxpayer. The logic is straightforward: the basic rate of income tax is 20%, and an additional 5% serves as a cushion for National Insurance contributions, as well as any unforeseen expenses or changes in tax law.

This 25% guideline usually suffices due to the tax-free personal allowance of £12,570 and deductible business expenses that often lower your effective tax rate.

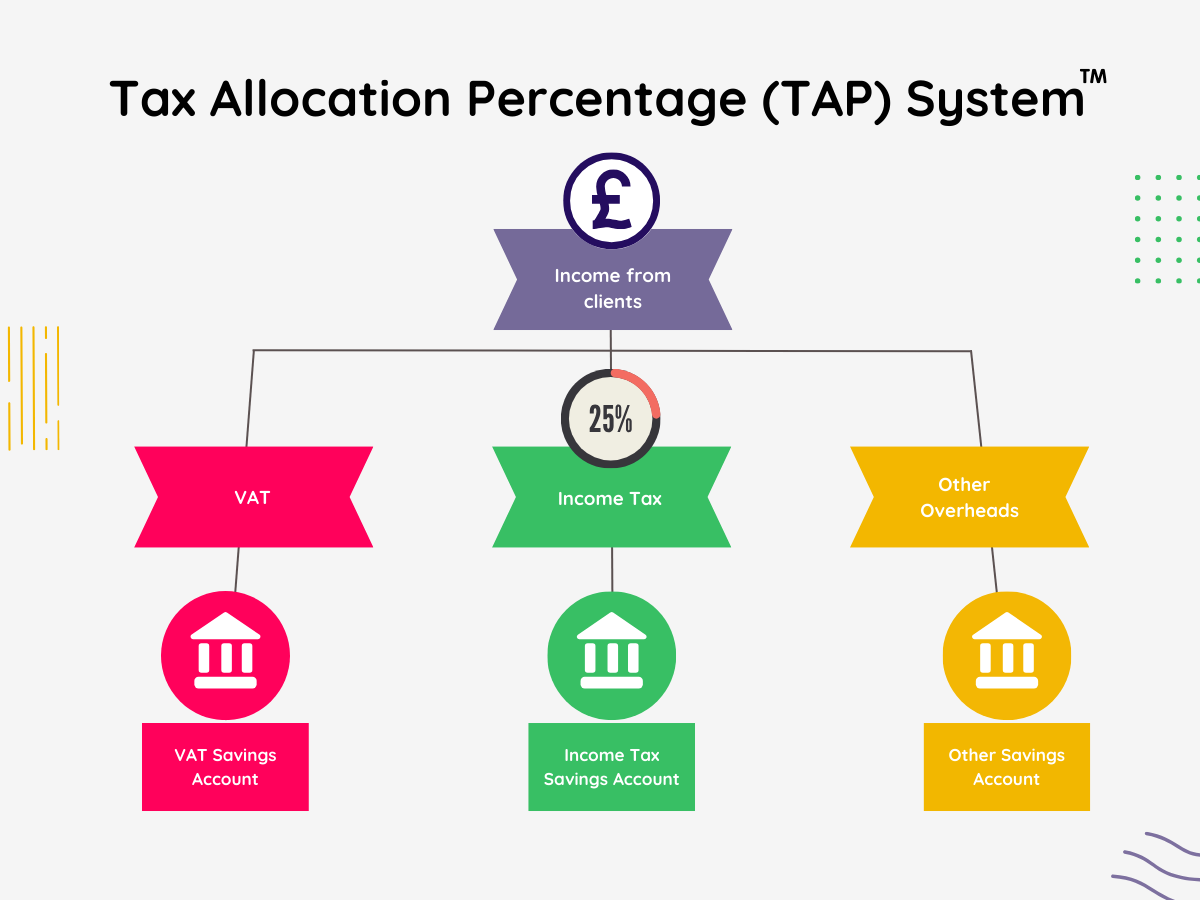

Tax Allocation Percentage (TAP)

For my accounting clients, I recommend using our Tax Allocation Percentage (TAP) system to streamline their tax savings. It's a straightforward method we've developed that involves allocating a set percentage of your banked income into a separate savings account designated for taxes.

For example, if you deposit £1,000 from a client into your bank account, using the TAP method, you would then transfer £250, which is 25% of the £1,000, into your tax savings account. We strongly advise our clients to establish separate bank accounts for each tax type that's applicable—whether it's income tax, corporation tax, VAT and other overheads. This ensures that funds allocated for one tax aren't accidentally used for another, simplifying your financial management.

Payments on Account

If your tax bill exceeds £1,000, you'll find yourself navigating the Payments on Account (POA) system. Many view this as an unfair requirement because it demands advance payments for the next tax year, often based on profits not yet earned.

For example, let's say your total tax due for the 2022/23 tax year is £2,000. Under the Payments on Account system, you would be required to make a total payment of £3,000 in January 2024. This amount consists of the £2,000 due for that year, plus an additional £1,000, which represents 50% of the £2,000 for the next tax year.

Six months later, in July 2024, you'd need to pay the remaining £1,000 (the other 50%). These Payments on Account are then deducted from the following year's tax liability (for the 2023/24 tax year), and any balance is either made up or refunded by HMRC.

key takeaway

If your tax bill is over £1,000, be prepared for the Payments on Account system, which requires advance payments for the next tax year and may affect your cash flow.

Progressive Tax Rates: Know Your Brackets

| Band | Taxable Income | Tax Rate |

|---|---|---|

| Personal Allowance | Up to £12,570 | 0% |

| Basic rate | £12,571 to £50,270 | 20% |

| Higher rate | £50,271 to £125,140 | 40% |

| Additional rate | Over £125,140 | 45% |

In the UK, tax rates are progressive, not flat. If your side hustle income crosses into a higher tax bracket, say above £50,271, you'll need to adjust your saving percentage accordingly.

Other Considerations

Additional liabilities such as Value Added Tax (VAT) may also apply if your turnover (sales income) crosses a particular threshold, currently £85,000 on a rolling twelve-monthly basis.

Pensions and other qualifying expenses should be factored into your tax calculations as well.

FAQs

Final thoughts

the 25% rule serves as a solid foundation for basic rate taxpayers.

However, everyone's situation is different. Utilising a system like TAP can help manage your various tax responsibilities more effectively. For personalised advice, it's always best to consult with a chartered accountant.

sidehustles.co.uk one-minute podcast

🎧 Listen Now: Sidehustles.co.uk

One-Minute Podcast – Navigating Tax Payments using the TAP system.

A freelancer in our network had been grappling with tax payment issues, often finding herself stressed as the deadline for her Self-Assessment Tax Return approached. However, after implementing the Tax Allocation Percentage (TAP) system, her financial management transformed. She started setting aside the suggested 25% of her income into a designated savings account just for taxes, which made her annual Self-Assessment a much smoother process. Even more beneficial was how this system equipped her to adapt seamlessly when she transitioned to a higher tax bracket.

share this article

WHAT ARE OTHER PEOPLE READING?